Navigating through the maze of state taxation, you might be surprised at the variety of sneaky taxes that could be lightening your wallet without your full awareness. These creative revenue streams range from the environmentally motivated to the digitally driven, each with its own rationale but with one common goal: to boost state funds in unique ways.

1. Electric Vehicle Fees

In states like Texas, owning an electric vehicle comes with a significant additional annual fee, aimed at offsetting lost gasoline tax revenues. While promoting green transportation on one hand, this fee paradoxically penalizes those who choose it.

2. EV Registration Charges

Several states impose extra registration fees on electric and hybrid vehicles, ostensibly to cover the environmental cost of their batteries and lost fuel tax revenue. This creates an additional financial burden for eco-conscious drivers.

3. Mileage-Based Taxes

As gas tax revenues decline, some states are experimenting with charging drivers based on the number of miles they drive rather than the fuel they consume, an approach that raises privacy and equity concerns.

4. Streaming Services Tax

Digital entertainment isn’t immune to taxation, with some jurisdictions applying an amusement tax to streaming services. This modern twist on the sin tax affects anyone looking to unwind with their favorite shows and movies.

5. Bag Taxes

Aimed at reducing plastic waste, bag taxes charge shoppers for each plastic bag provided at checkout. While environmentally motivated, it’s another added cost for consumers.

6. Soda Taxes

Taxes on sugary drinks, intended to combat obesity and health issues, add a few cents per ounce to the cost of sodas and other sweetened beverages, making that guilty pleasure a bit pricier.

7. Candy and Snack Taxes

In a similar vein to soda taxes, some states tack on extra charges for candy and snacks, categorizing them as luxury items rather than necessities and taxing them at a higher rate.

8. Sin Taxes

Alcohol and cigarettes have long been targets for higher taxes due to their health implications. These “sin taxes” are intended both to deter consumption and to generate significant revenue.

9. Tourism Taxes

Hotel stays and rental car fees often include additional taxes aimed at tourists rather than residents, a way for states to earn revenue from visitors enjoying their amenities.

10. Tanning Salon Taxes

In an effort to discourage the use of potentially harmful tanning beds, some states impose an extra tax on tanning salon services, blending health policy with revenue generation.

11. Fireworks Taxes

Seasonal taxes on fireworks sales not only increase state coffers around national holidays but also attempt to limit their use by making them more expensive.

12. Fast Food Taxes

Fast food joints in certain areas might have an additional tax applied to their meals, targeting the quick-service industry for its environmental and health impacts.

13. Luxury Item Taxes

Expensive cars, jewelry, and other high-end purchases can come with luxury taxes, targeting those with the means to afford them and raising funds from high-dollar transactions.

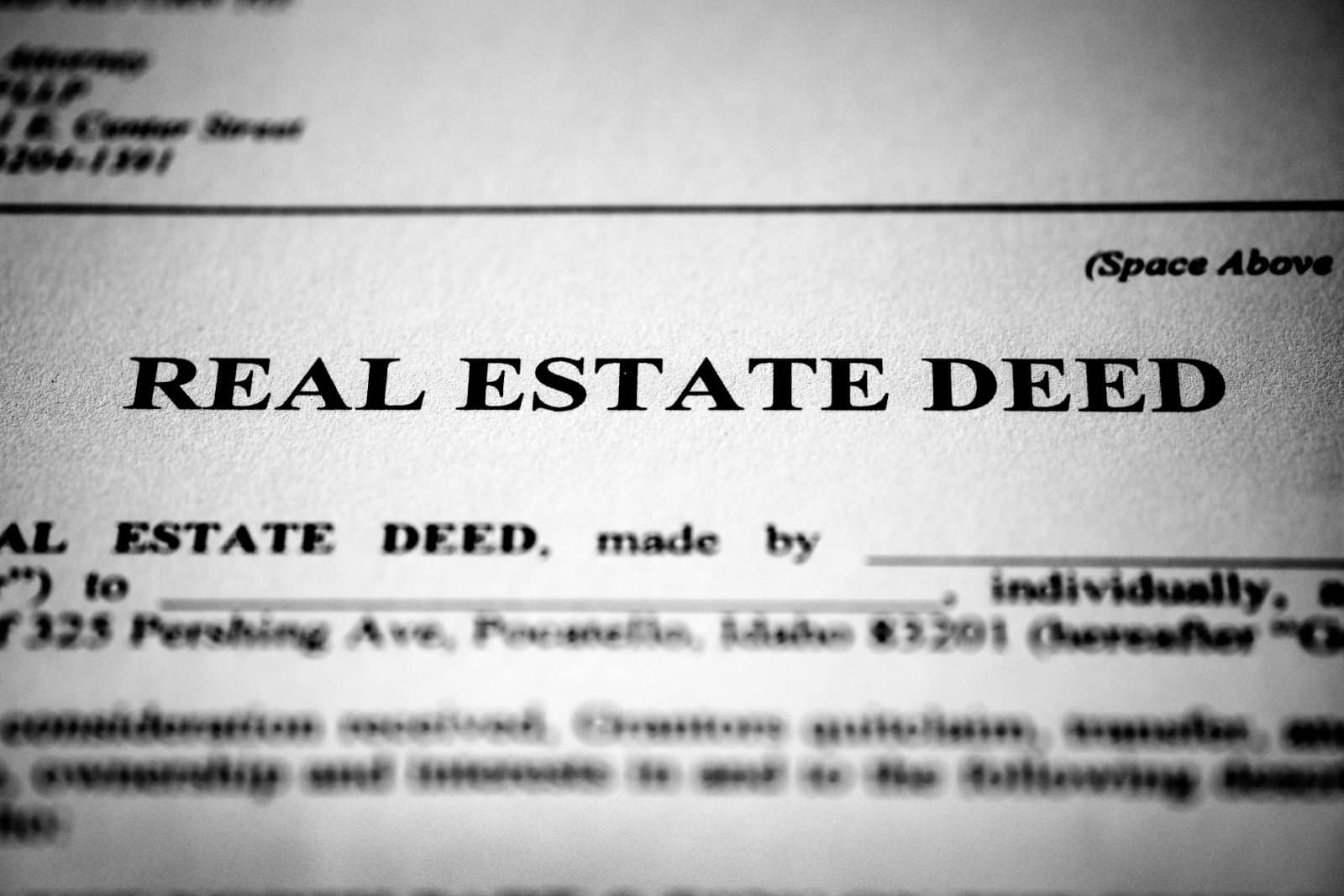

14. Property Transfer Taxes

Selling or transferring property? Some states will take a slice of the pie through taxes on the transaction, adding to the complexity and cost of real estate deals.

15. E-Cigarette Taxes

As vaping has surged in popularity, states have begun taxing e-cigarettes and related products, seeing them as a new frontier for public health taxation.

16. Gym Membership Taxes

Believe it or not, staying fit can cost you more in some states that tax gym memberships and wellness services, an ironic penalty on personal health investments.

17. Amusement Park Taxes

Seeking thrills at an amusement park? Be prepared for added taxes on your admission ticket, as states look to capitalize on leisure activities.

18. Sports Betting Taxes

With the legalization of sports betting in many states, governments are quick to levy taxes on your potential winnings, ensuring they get a piece of the action.

19. Digital Download Taxes

Music, apps, and e-books might carry an additional tax for digital downloads in some states, reflecting the shift from physical to digital consumption.

20. Environmental Taxes

From charges on hazardous waste to penalties for excessive water usage, environmental taxes aim to promote sustainability by taxing the use of natural resources.

Tax Tally

From the roads we drive on to the shows we stream, taxes find their way into many aspects of our daily lives, often in the most unexpected places. While some of these taxes support commendable causes, others might leave you scratching your head. Whatever the case, staying informed helps you navigate the choppy waters of state taxation with a bit more savvy.

The post 20 Clever Taxes States Impose Without You Noticing first appeared on Pulse of Pride.

Featured Image Credit: Shutterstock / David McGill 71.

The content of this article is for informational purposes only and does not constitute or replace professional financial advice.

For transparency, this content was partly developed with AI assistance and carefully curated by an experienced editor to be informative and ensure accuracy.